What is your favorite app to stream video content? My personal favorite is Paramount+ because of my addictions to MTV’s The Challenge and Yellowstone. But quite frankly, it could change by the quarter given that, from a consumer perspective, it’s a pretty saturated market.

While consumers are busy making choices on what content they want to watch, it’s a different story for media strategists at Arm Candy. Connected TV (CTV) is a proven way to drive high ad recall, generate brand awareness and also boost organic search. And, from a paid media perspective, the actual CTV platform has less to do with building a strategy than the business outcome, and ultimately, the target audience for the content.

However, the topic of CTV platforms with clients has been more prevalent since Netflix introduced their ad-supported subscriptions.

Insert Netflix…as a hard no.

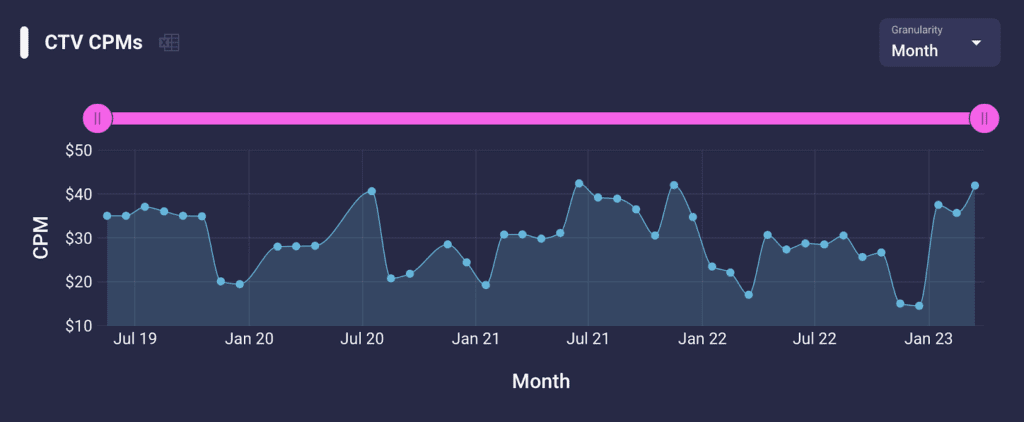

Depending on seasonality and targeting, Arm Candy’s media intelligence tech, CYRIS, shows CTV rates ranging anywhere from $14 to $42, with an average around $30.

Last fall, advertisers across all industries were interested in CTV and getting their ads in front of the coveted Netflix consumer. However, Netflix’s initial CPMs were $65 to $85 with a rumored $10M commitment. Netflix did not provide enough efficiencies to justify a media investment on its platform when a typical CTV campaign could achieve the same result, reaching more people with a less outrageous media commitment.

Another struggle in choosing Netflix for a media strategy is targetability. As is the trend for massive companies in ad tech like Google and Facebook, Netflix allows for only its first-party data when it comes to audience targeting. This makes Netflix a good choice for contextual targeting or products with mass appeal that require minimal interest or behavioral segmentation.

New platforms (almost always) struggle

Regardless of the size of the user base for a platform, any new ad tech platform is bound to have limitations, especially compared to the types of outcomes Facebook and Google can produce. Targeting segmentation is certainly a limitation, and the ability to retarget consumers who viewed the ads with display or email would also be unavailable.

Right now, Netflix’s biggest challenge is scale. The company is currently providing make goods for under-delivery and slow pacing for executed contracts. WIth low and seemingly unpredictable inventory availability, guaranteed execution of any planned spends is unlikely.

The pros

There is no denying the appeal of advertising on Netflix. With over 200 million subscribers worldwide, any brand is certain to reach a relevant audience in a brand safe environment. Knowing the dedication that Netflix viewers have to the platform’s binge-worthy shows, there is potential for Netflix to pull more weight in the CTV space than programmatic options like SlingTV or Roku. A recent Kantar survey showed that 75% of viewers recalled a brand they saw advertised on Netflix. There is potential this could also be a result of its pre-roll format and on-demand content, with consumers engaged and ready to watch their show, rather than mid-roll ad content that feel more like commercials.

Netflix also may have heard the audible gasps from media strategists across the country from their exorbitant CPMs, and have since rolled back their rates to $50 CPMs. However, with the challenges to scale, it’s unlikely that rates will continue to decrease any time soon.

In the end…your CTV audience can be found in many other places.

Ad supported content is here to stay, with 57% of polled consumers opting into ads for cheaper content subscriptions. Regardless of how you prefer to stream your shows, it’s a favorable turn for advertisers, with easier access to high impact ads than ever before. It’s also possible that Netflix’s advertising platform becomes more accessible and mainstream; we’re still in early stages!

How likely are you to add Connected TV into your next media strategy? We are here for all your questions!