As COVID-19 continues to impact our daily lives, it’s important to understand the effects the pandemic is having on advertising. While some companies may find it economic to shut off ad spending, data from the 2008 recession as well as recent campaign data reflects an opportunity for brands who take advantage of the current landscape in which we find ourselves.

Overall, we have uncovered media efficiencies in several channels which builds a strong case for campaign continuity throughout the pandemic. Below are some insights that can be applied to existing campaigns for a more strategic, data-driven approach to your advertising efforts during COVID-19.

In summary, those who have a presence during this pandemic will come out ahead of those who do not, as was the case in 2008.

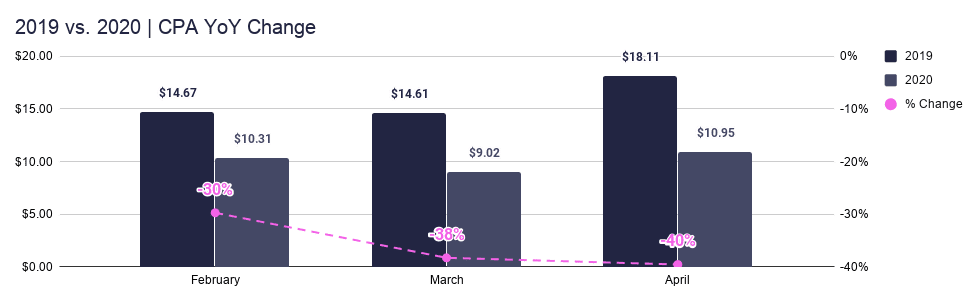

Media costs are down, significantly.

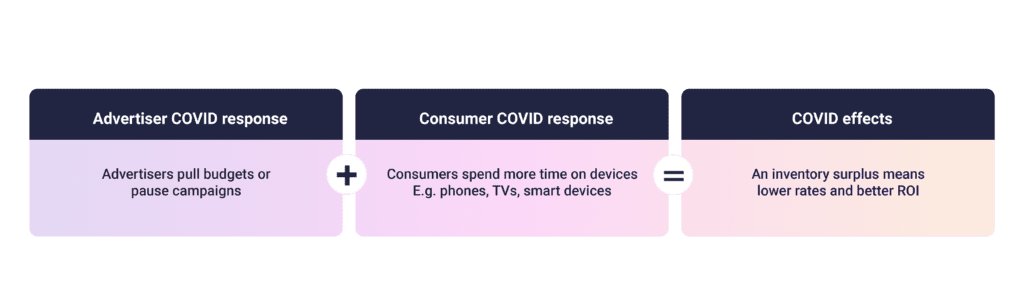

Once the pandemic hit, many advertisers pulled the plug on their media dollars, holding out for larger budgets later in the year. However, this large reduction in spend across many channels, in addition to the large increase of people using all types of devices, means there is a surplus of ad inventory.

Challenging times call for adaptive strategies and more frequent communication. Brands who advertise during a recession can win big [1], and consumers have even articulated they’d like brands to advertise vs. turning off all together during this trying period.

eMarketer “Consumers Don’t Think Brands Should Stop Advertising During Coronavirus Pandemic”

Channel insights

With the ability to get in front of more people with fewer advertising dollars, the coronavirus pandemic is a financially responsible time to spend ad dollars.

It’s probably the highest dislocation between ad spending and media consumption in the history of media.

– Tim Armstrong, Former CEO of AOL

TV

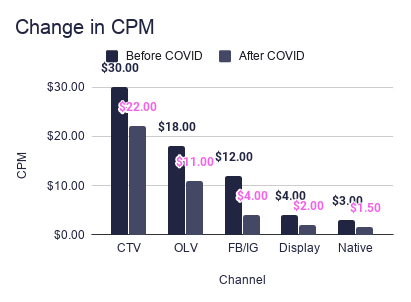

There is no better time than now to invest media dollars into TV advertising. Nielsen data shows that staying at home could lead to a 60% increase in content watched on television. Increased viewership is being seen across all TV platforms, making this the biggest opportunity for a brand during the pandemic. Due to surplus in supply, television providers are selling spots at massive discounts, helping extend advertising dollars 2-5x further than it typically would during this season.

To learn more, check out additional viewership information from NBC here.

Facebook/Instagram

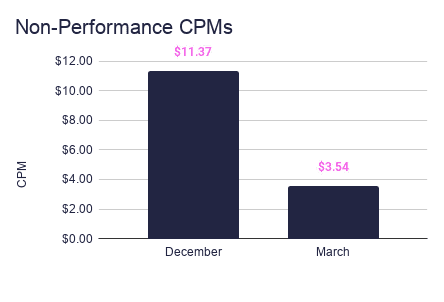

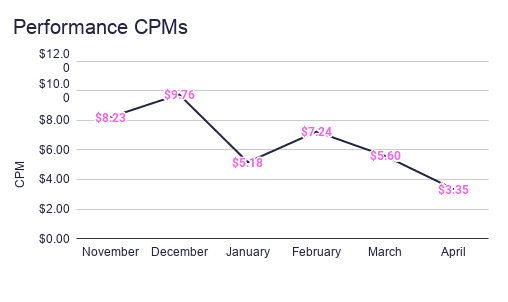

CPMs are going down on Facebook, which makes it an opportune time to run media dollars to maximize reach and overall returns on dollars being spent. Logically, these CPM reductions make sense as the platforms are auction-based. Non-performance brands and huge advertisers in the travel industry (airlines, hotels, etc.) in particular are pulling budgets and there’s less competition, yielding better CPMs.

For more information, check out this guide from Facebook here .

Channel insights

Search

Search is heavily dependent on the vertical the client is in as it is at the end of the consumer research process. In general, with many advertisers pulling spends, CPCs are continuing to decline, thus costs per results are too. Across the majority of industries, there’s an opportunity to take advantage of this channel if the product or service advertised can still receive value from sales, leads, app installs or other performance-based KPIs.

Display & Native

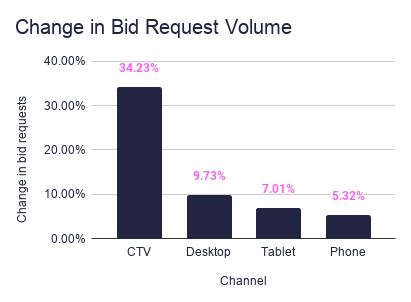

With bid requests on devices up 5% to 10%, there is a larger impression share on programmatic channels like display and native as well. More users means higher reach, and more inventory means lower rates, making it advantageous to invest advertising dollars in programmatic channels.

For more information, take a look at this digital report here.

Audio Streaming

The latest usage patterns show that users are settling into listening behaviors we would typically expect on weekends. We’re seeing midday consumption rise and weekday use of home connected devices on par with weekend use. Since March 14th, we see almost identical patterns of gaming console streaming on the weekend vs weekday globally: 34% of evening streams on weekdays compared to 32% on the weekend.

Video watch time on Twitter is on the rise. Compared to March 2019, U.S. video minutes watched is up 78% in the U.S.

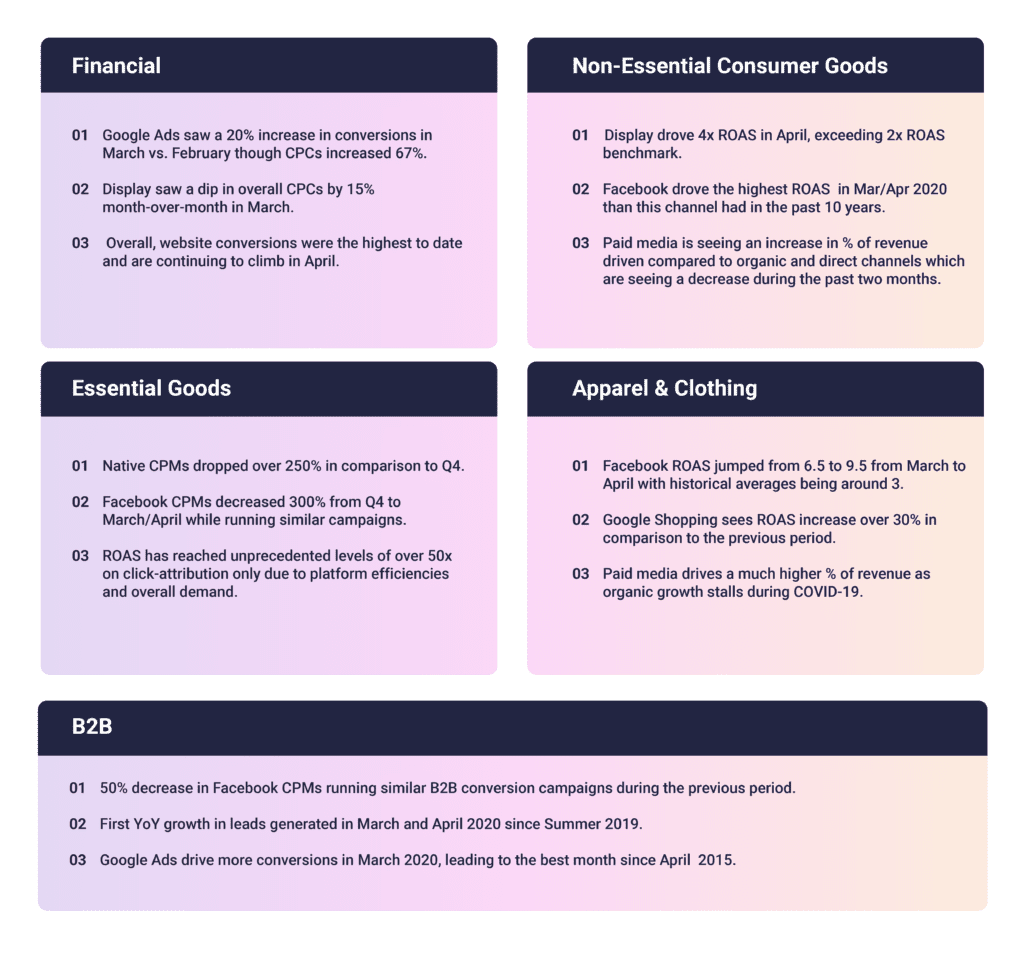

Key Statistics By Industry